Adressing Risk

Oct 31, 2025

Understanding risk correctly and addressing it smarter

By Barbara Stadermann and Peter Brock, BeeWyzer GmbH

In mainstream media, we always read a lot about returns, yields and performances. Still, most investors would probably have a hard time defining these terms in a mathematically and economically correct manner. On the other hand, risk is rarely discussed—why not?

Let's start with some basics: when assessing risk, insurers before employing actuaries would simply assess the probability of entry and the expected damage or loss. This leaves us with four quadrants of positioning and three possible actions: if probability entry and expected damage are high, insurance coverage is a must. If both are low, it would only give you an unnecessary cost item. If one is high and the other is low, the decision becomes more challenging.

The financial services industry takes a different approach for HNWI: it will look at their risk-bearing ability and their risk tolerance. We prefer the insurers' approach, as even those who can stand losses easily do not necessarily want to suffer them. And mental resilience is not something that can be determined in a consultation mode, but only in real life, when things really hit the fan...

When looking at all the different asset classes, numerous risks become visible, but we want to look at overall risk for investors in this article. Often volatility is given as a measure of risk, but what exactly is it?

In financial mathematics, volatility is the squared standard deviation. It thus corresponds to the variance known from statistics and always assumes a positive value. If you did not get this at school, ask Dr. Google and look out for online tutorials. But the real issue with volatility is, that it is basically looking through the rear window rather than the windscreen.

Every trading day a new data point is calculated in, the oldest one drops out. So over a calm trading period, this measure will automatically go down with time, even though there may be big risks ahead, maybe not yet visible.

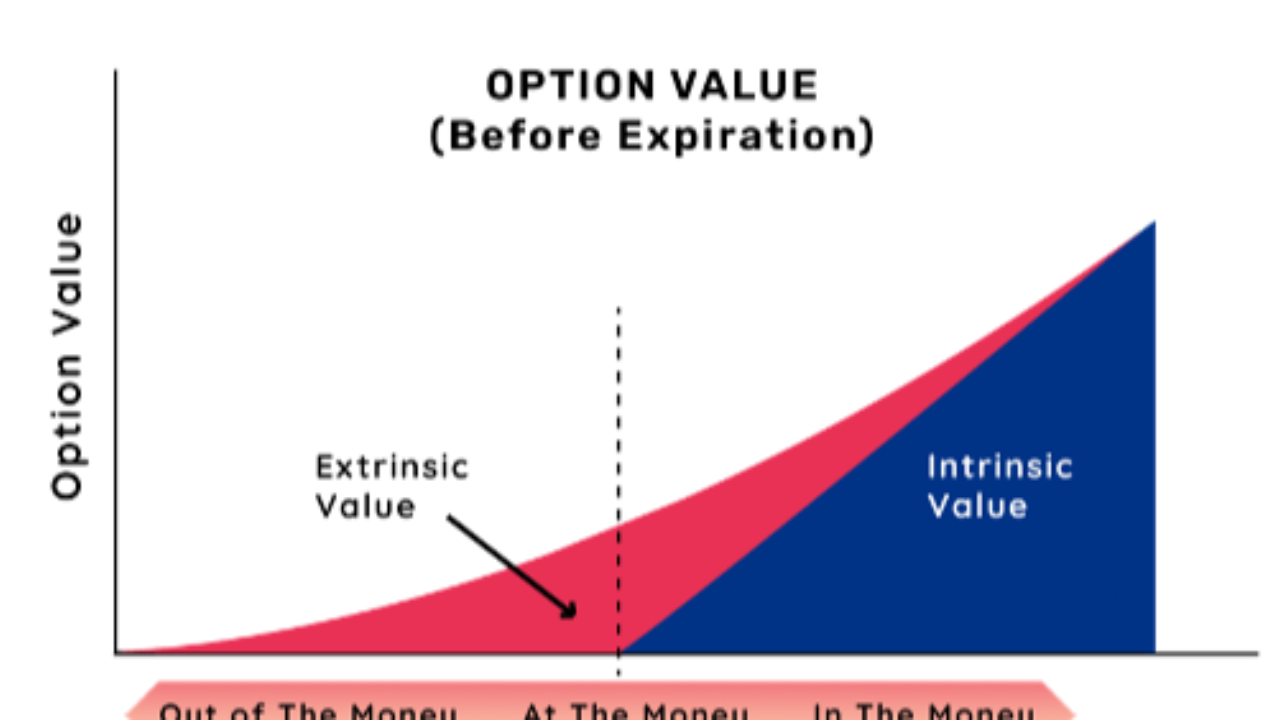

Philosophically, “vola” being always a positive figure is a perfect reflection of the semantic identity of ‘opportunity’ and ‘risk’ in Mandarin. So, let’s bring this thought into stock market investing: anyone who buys a stock gets three potential sources of value into their portfolio: stock price, dividends and volatility. The stock price performance can be positive, zero, or negative. Dividends can be positive or zero, but they will never be negative. Volatility, on the other hand, is always positive. Most private investors automatically enjoy stock price and dividend buying and holding the stock, but they only passively experience volatility without taking any extra profit from it. Sophisticated investors often do things differently by collecting option premiums via a volatility overlay strategy.

So, besides hedging all or parts of your portfolio with options and futures occasionally or all the time (for example with deep-out-of-the-money puts), thus paying insurance premia, there is maybe a different way of addressing risk: combining risk-oriented transactions with options with the underlying stocks in your portfolio in order to generate additional income from option premia at reduces or controlled risk, leaving you less exposed to market direction.

You could potentially get into a new position by selling a put option. Or reduce another one by selling covered calls. Or you realize profits by selling a complete position and invest a part of the gain in a call option that leaves you with some exposure to the stock, if you think the party may not be over.

However, in the long run this approach requires knowledge, experience and strict trading rules. Not everybody will be able to spend the amount of time and energy needed to get there. Some find an experienced broker that con offer assistance, but time and endeavor will still be of the essence. But who embarks on this journey will ultimately be rewarded with additional income, a more resilient portfolio and the good feeling of not having left money on the table.

Remember your first ride on a roller coaster as a kid: you learned that risk is not only frightening, it can be fun also with the right technical setting. Let us add this experience to the way we tackle the markets!

DOWNLOAD OUR WEALTH ROBUSTNESS INDICATOR FOR FREE!

Take a closer look inside the exclusive Next Gen Masterclass program helping you manage, secure and transfer wealth effectively.

We hate SPAM. We will never sell your information, for any reason.