Adressing Risk

Oct 31, 2025

Stablecoins as inflationary tool

Jun 02, 2025

Strategic Asset Allocation for Private Investors

Feb 27, 2025

financial education as government task?

Apr 29, 2023

SOME THOUGHTS ON 2023

Jan 16, 2023

Interview with German Manager Magazin

Feb 23, 2022

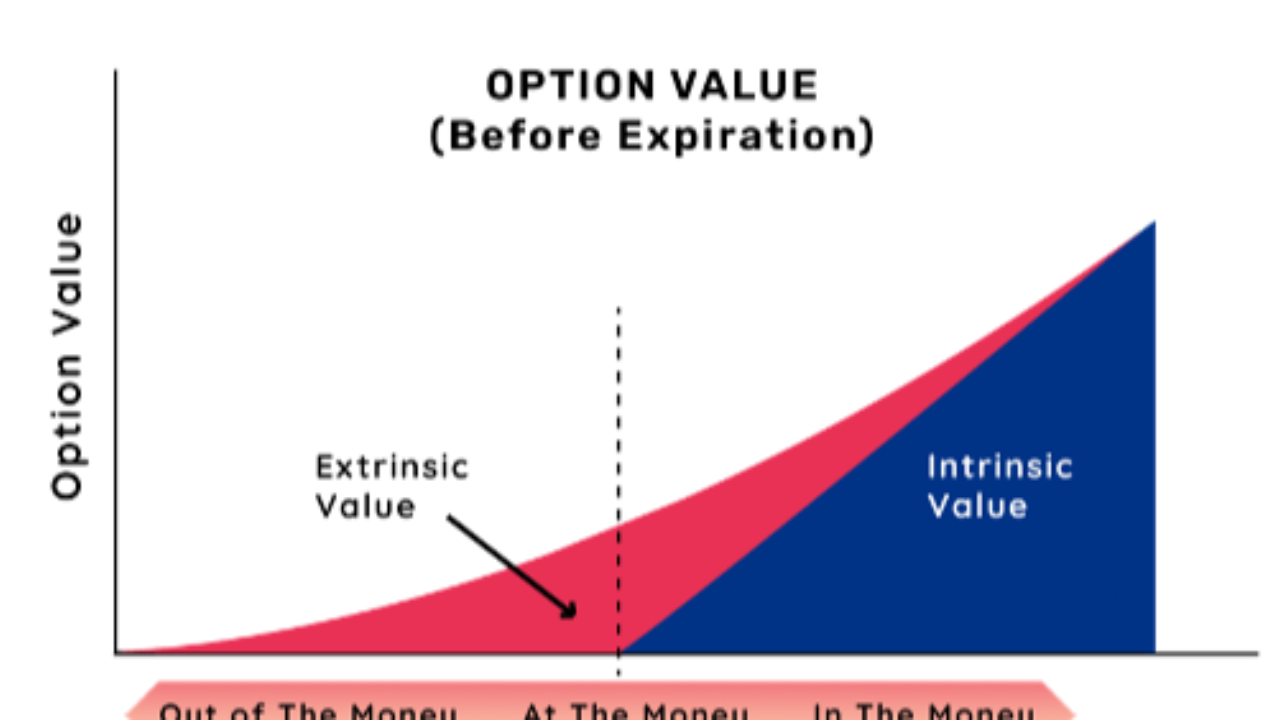

Asset Allocation Thoughts 2022

Dec 28, 2021

FINANCIAL PLANNING FOR BIGGER WEALTH?

Sep 04, 2021

THE INFLATION FEAR

May 19, 2021

IMPACT INVESTING IN EUROPE

Nov 02, 2020

Merchant banking approach of families of wealth

Sep 04, 2020