Asset Allocation Thoughts 2022

Dec 28, 2021

INVEST LIKE A PROFESSIONAL

Professional investors are currently moving towards anticyclical investing in order to shield off against inflation and market risk. It is also reflected in the media by now (e.g German newspaper Handelsblatt (Nr. 220, weekend edition 12. - 14. November 2021, page 38). This could be a good template for your own investment decision in the coming year 2022!

Professional investors, but ultimately all investors, are currently faced with at least three major issues: upcoming inflation, that we already discussed in our latest blogs, overvaluation of mainly US-based tech stocks and careless handling of the continued global Covid-19 pandemic, still overshadowing the global economic outlook.

Inflation we have discussed already: now an increasing number of market analysts sees the current rise of wholesale and retail prices not as a short-term phenomenon anymore, but believes that higher inflation might be here to stay for a longer while.

US tech giants like Facebook / Meta, Google, Tesla or Microsoft dominate the US stock market, but globally tech valuations have become quite aggressive even though there seems to be no end to their rally yet. That is why more and more investors are looking for alternatives and identified global Small- & Mid-Cap markets, reflecting more the intrinsic value of the company as market moods – at least most of the time. With regard to inflation, it is recommended to invest in companies that do not simply hold cash, but invest in growing markets with short production cycles, which is a pattern of innovative global SME ́s.

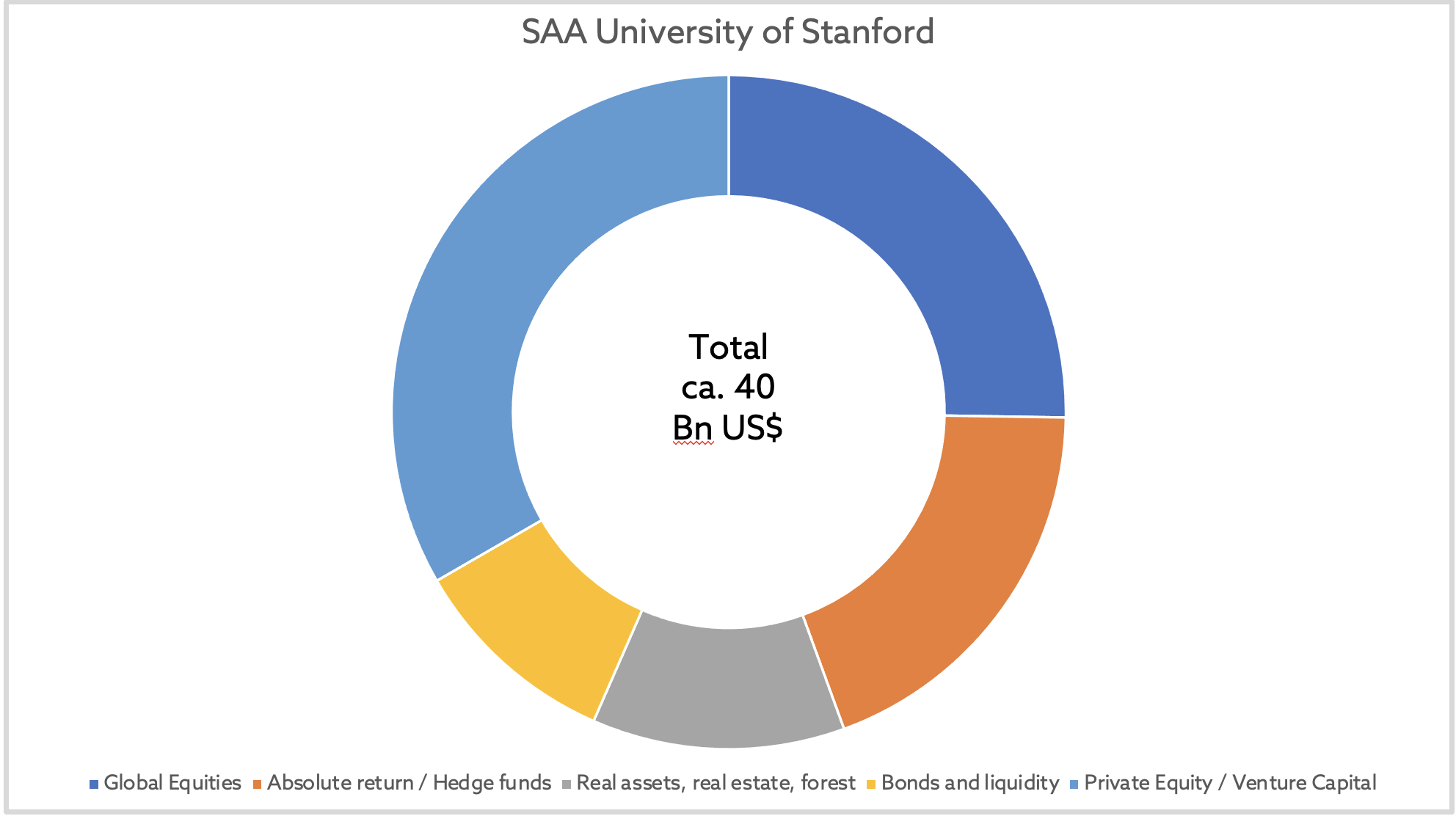

The other big persisting trend is a renewed focus on Private Equity and Venture Capital plus other real assets like real estate, forest or sustainable projects of all kind. For example, a German church fund has recently increased its exposure to PE / VC from 19 to 36%, a trend often seen in institutional portfolios. Some even increase the share of this asset class to around 50%. See also the allocation of 33% in the University of Stanford portfolio in the chart below. All of this reflects the low or negative returns in the bond markets and the increased risk in the stock markets after a decade of rallying.

The focus on real assets is also a response to continued uncertainty with the global Covid- pandemic, resulting in a distortion of global trade flow and logistical chains, causing scarcity of components in the electronics and automotive industries. As this could continue for some time with global production patterns being revisited by both large and small corporates, the pandemic is looming over any strategic asset allocation decision.

By the way, many investors are increasingly skeptical regarding the gold price, as this is rather high also and a negative proxy of the USD as global reserve currency. In difficult times reserve currencies usually attract inflows leading to an appreciation, which in return would be negative for the gold price – ceteris paribus, which means other things being equal.

So, a balanced SAA similar for example to that of Stanford University could be a wise guideline for any asset allocation for the time ahead. However, individual factors like assets and liabilities, cashflow needs and personal experience must stand above such a guideline. Those who have studied the BeeWyzer Method will apply all this to their own investment plans accordingly.

Here is the asset allocation of Stanford University:

DOWNLOAD OUR WEALTH ROBUSTNESS INDICATOR FOR FREE!

Take a closer look inside the exclusive Next Gen Masterclass program helping you manage, secure and transfer wealth effectively.

We hate SPAM. We will never sell your information, for any reason.